Markov switching multifractal

In financial econometrics, the Markov-switching multifractal (MSM) is a model of asset returns that incorporates stochastic volatility components of heterogeneous durations.[1][2] MSM captures the outliers, log-memory-like volatility persistence and power variation of financial returns. In currency and equity series, MSM compares favorably with standard volatility models such as GARCH(1,1) and FIGARCH both in- and out-of-sample. MSM is used by practitioners in the financial industry to forecast volatility, compute value-at-risk, and price derivatives.

Contents |

MSM specification

The MSM model can be specified in both discrete time and continuous time.

Discrete time

Let  denote the price of a financial asset, and let

denote the price of a financial asset, and let  denote the return over two consecutive periods. In MSM, returns are specified as

denote the return over two consecutive periods. In MSM, returns are specified as

where  and

and  are constants and {

are constants and { } are independent standard Gaussians. Volatility is driven by the first-order latent Markov state vector:

} are independent standard Gaussians. Volatility is driven by the first-order latent Markov state vector:

Given the volatility state  , the next-period multiplier

, the next-period multiplier  is drawn from a fixed distribution

is drawn from a fixed distribution  with probability

with probability  , and is otherwise left unchanged.

, and is otherwise left unchanged.

drawn from distribution drawn from distribution  |

with probability  |

|

with probability  |

The transition probabilities are specified by

.

.

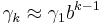

The sequence  is approximately geometric

is approximately geometric  at low frequency. The marginal distribution

at low frequency. The marginal distribution  has a unit mean, has a positive support, and is independent of

has a unit mean, has a positive support, and is independent of  .

.

Binomial MSM

In empirical applications, the distribution  is often a discrete distribution that can take the values

is often a discrete distribution that can take the values  or

or  with equal probability. The return process

with equal probability. The return process  is then specified by the parameters

is then specified by the parameters  . Note that the number of parameters is the same for all

. Note that the number of parameters is the same for all  .

.

Continuous time

MSM is similarly defined in continuous time. The price process follows the diffusion:

where  ,

,  is a standard Brownian motion, and

is a standard Brownian motion, and  and

and  are constants. Each component follows the dynamics:

are constants. Each component follows the dynamics:

drawn from distribution drawn from distribution  |

with probability  |

|

with probability  |

The intensities vary geometrically with  :

:

When the number of components  goes to infinity, continuous-time MSM converges to a multifractal diffusion, whose sample paths take a continuum of local Hölder exponents on any finite time interval.

goes to infinity, continuous-time MSM converges to a multifractal diffusion, whose sample paths take a continuum of local Hölder exponents on any finite time interval.

Inference and closed-form likelihood

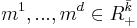

When  has a discrete distribution, the Markov state vector

has a discrete distribution, the Markov state vector  takes finitely many values

takes finitely many values  . For instance, there are

. For instance, there are  possible states in binomial MSM. The Markov dynamics are characterized by the transition matrix

possible states in binomial MSM. The Markov dynamics are characterized by the transition matrix  with components

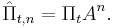

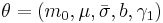

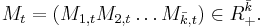

with components  . Conditional on the volatility state, the return

. Conditional on the volatility state, the return  has Gaussian density

has Gaussian density

Conditional distribution

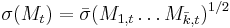

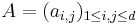

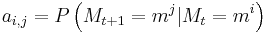

We do not directly observe the latent state vector  . Given past returns, we can define the conditional probabilities:

. Given past returns, we can define the conditional probabilities:

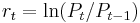

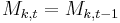

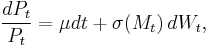

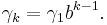

The vector  is computed recursively:

is computed recursively:

where  ,

,  for any

for any  , and

, and

The initial vector  is set equal to the ergodic distribution of

is set equal to the ergodic distribution of  . For binomial MSM,

. For binomial MSM,  for all

for all  .

.

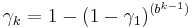

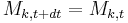

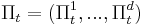

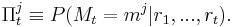

Closed-form Likelihood

The log likelihood function has the following analytical expression:

Maximum likelihood provides reasonably precise estimates in finite samples.[2]

Other estimation methods

When  has a continuous distribution, estimation can proceed by simulated method of moments,[3][4] or simulated likelihood via a particle filter.[5]

has a continuous distribution, estimation can proceed by simulated method of moments,[3][4] or simulated likelihood via a particle filter.[5]

Forecasting

Given  , the conditional distribution of the latent state vector at date

, the conditional distribution of the latent state vector at date  is given by:

is given by:

MSM often provides better volatility forecasts than some of the best traditional models both in and out of sample. Calvet and Fisher[2] report considerable gains in exchange rate volatility forecasts at horizons of 10 to 50 days as compared with GARCH(1,1), Markov-Switching GARCH,[6][7] and Fractionally Integrated GARCH.[8] Lux[4] obtains similar results using linear predictions.

Applications

Multiple assets and value-at-risk

Extensions of MSM to multiple assets provide reliable estimates of the value-at-risk in a portfolio of securities.[5]

Asset pricing

In financial economics, MSM has been used to analyze the pricing implications of multifrequency risk. The models have had some success in explaining the excess volatility of stock returns compared to fundamentals and the negative skewness of equity returns. They have also been used to generate multifractal jump-diffusions.[9]

Related approaches

MSM is a stochastic volatility model[10][11] with arbitrarily many frequencies. MSM builds on the convenience of regime-switching models, which were advanced in economics and finance by James D. Hamilton.[12][13] MSM is closely related to the Multifractal Model of Asset Returns.[14] MSM improves on the MMAR’s combinatorial construction by randomizing arrival times, guaranteeing a strictly stationary process. MSM provides a pure regime-switching formulation of multifractal measures, which were pioneered by Benoit Mandelbrot.[15][16][17]

See also

- Brownian motion

- Markov chain

- Multifractal model of asset returns

- Multifractal

- Stochastic volatility

References

- ^ Calvet, Laurent; Adlai Fisher (2001). "Forecasting multifractal volatility". Journal of Econometrics 105: 27–58. doi:10.1016/S0304-4076(01)00069-0.

- ^ a b c Calvet, Laurent; Adlai Fisher (2004). "How to Forecast long-run volatility: regime-switching and the estimation of multifractal processes". Journal of Financial Econometrics 2: 49–83. doi:10.1093/jjfinec/nbh003.

- ^ Calvet, Laurent; Adlai Fisher (2002). Regime-switching and the estimation of multifractal processes. http://www.cirano.qc.ca/realisations/grandes_conferences/risques_financiers/25-10-02/Calvet-Fisher.pdf.

- ^ a b Lux, Thomas (2008). "The Markov-switching multifractal model of asset returns: GMM estimation and linear forecasting of volatility". Journal of Business and Economic Statistics 26: 194–210.

- ^ a b Calvet, Laurent; Adlai Fisher, and Samuel Thompson (2006). "Volatility comovement: a multifrequency approach". Journal of Econometrics 131: 179–215. doi:10.1016/j.jeconom.2005.01.008.

- ^ Gray, Stephen (1996). "Modeling the conditional distribution of interest rates as a regime-switching process". Journal of Financial Economics 42: 27–62. doi:10.1016/0304-405X(96)00875-6.

- ^ Klaassen, Franc (2002). "Improving GARCH volatility forecasts with regime-switching GARCH". Empirical Economics 27: 363–394. doi:10.1007/s001810100100.

- ^ Bollerslev, Tim; H. O. Mikkelsen (1996). "Modeling and pricing long memory in stock market volatility". Journal of Econometrics 73: 151–184. doi:10.1016/0304-4076(95)01736-4.

- ^ Calvet, Laurent; Adlai Fisher (2008). "Multifractal Volatility: Theory, Forecasting and Pricing". Elsevier - Academic Press..

- ^ Taylor, Stephen (1986). "Modelling Financial Time Series". New York: Wiley..

- ^ Wiggins, James (1987). "Option values under stochastic volatility: theory and empirical estimates". Journal of Financial Economics 19: 351–372. doi:10.1016/0304-405X(87)90009-2.

- ^ Hamilton, James (1989). "A new approach to the economic analysis of nonstationary time series and the business cycle". Econometrica (The Econometric Society) 57 (2): 357–84. doi:10.2307/1912559. JSTOR 1912559.

- ^ Hamilton, James (2008). "Regime-Switching Models". New Palgrave Dictionary of Economics (2nd edition). Palgrave McMillan Ltd.

- ^ Calvet, Laurent; Adlai Fisher and Benoit Mandelbrot (1997). "A multifractal model of asset returns". Discussion Papers , Cowles Foundation Yale University.: 1164–1166.

- ^ Mandelbrot, B. (1974). "Intermittent turbulence in self-similar cascades: divergence of high moments and dimension of the carrier". Journal of Fluid Mechanics 62: 331–58. doi:10.1017/S0022112074000711.

- ^ Mandelbrot, B. (1982). "The Fractal Geometry of Nature". New York: Freeman.

- ^ Mandelbrot, B. (1999). "Multifractals and 1/f Noise: Wild Self-Affinity in Physics". Springer.

External Links

Financial Time Series, Multifractals and Hidden Markov Models

![f( r_t | M_t = m_i) = \frac{1} {\sqrt{2\pi\sigma^2(m^j)}}\exp\left[-\frac{(r_t-\mu)^2}{2\sigma^2(m^j)}\right] .](/2012-wikipedia_en_all_nopic_01_2012/I/65ee356fb6ecf7f45342b1cce493ac09.png)

![\Pi_t = \frac{\omega(r_t)*(\Pi_{t-1}A)}{[\omega(r_t)*(\Pi_{t-1}A)]\textbf{1}'}.](/2012-wikipedia_en_all_nopic_01_2012/I/ede90480d6bc2f426be1fa421fa4928d.png)

![\omega(r_t)=\left[f(r_t|M_t=m^1);\dots;f(r_t|M_t=m^d)\right].](/2012-wikipedia_en_all_nopic_01_2012/I/1c2ef98a92a691b5d5a531616c2635b9.png)

![\ln L(r_1,\dots,r_T;\theta) = \sum_{t=1}^{T}\ln[\omega(r_t).(\Pi_{t-1}A)].](/2012-wikipedia_en_all_nopic_01_2012/I/7b4d736ffdf6e1fefc3c37458e19690d.png)